Opinion: Problems and Opportunities Emerge From Shifts in China’s Exports by Vincent Chan

By Vincent Chan

More and more, it is looking like China will no longer be able to chiefly depend on shipping the products that helped turn it into an export powerhouse to its traditional markets to maintain its status as a trade superstar.

The pick-up in Chinese exports to emerging markets, particularly the members of the Association of Southeast Asian Nations (ASEAN), holds some promise, but there are several good reasons why the bloc will not be able to completely replace the European and American markets for China.

In the coming years, the country will remain an exporting power, with new-energy vehicles (NEVs) and related products being the driving force behind its export growth.

Starting in the early 1990s, China’s bread and butter in trade was exporting electronics and light industrial products to the European and U.S. markets. This has been changing over the past few years, and the trend has grown all the more evident this year.

In the first four months of 2023, China’s exports of high-tech products — mainly electronics and electronic components — fell 13.4% in dollar terms from the same period in 2022. Meanwhile, exports of textiles declined 8% year-on-year.

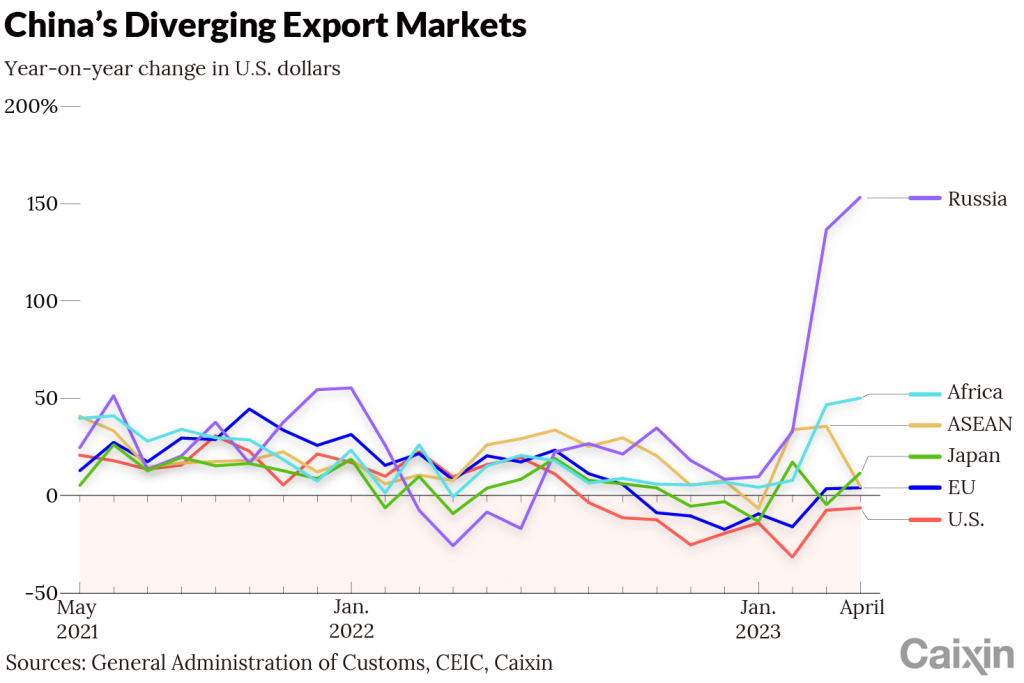

There has also been a notable shift in the destinations of China’s exports. During the January-April period, goods exports to the U.S. slid 14.3% year-on-year. Exports to the European Union fared slightly better but still slipped 4.3% year-on-year.

The significance of ASEAN as an export market for China has rapidly increased. In the first four months this year, China’s exports to the bloc grew to $185 billion, a 15% year-on-year jump.

ASEAN has now become China’s largest export market. However, because ASEAN is less economically developed than Europe or the U.S. — with a lower per capita GDP — its share of China’s electronics and other consumer goods exports is lower than either Europe or the U.S. Also, due to its geographic proximity to China, ASEAN imports a considerable amount of bulk raw materials from China, which otherwise would have generated higher transportation costs.

In the long term, ASEAN presents both opportunities and challenges for China. On the one hand, a growing ASEAN economy would mean greater demand for Chinese products. On the other hand, the bloc is also emerging as China’s major competitor in exporting to Europe and the U.S. As more midstream and upstream production lines shift to Southeast Asia, ASEAN’s demand for China’s semi-finished products will gradually decline.

In terms of products, growth in China’s exports of automobiles and batteries, especially those used in NEVs, stood out. From January to April, auto exports shot up 104% year-on-year by value, while storage battery exports rose 65%. In recent years, exports of these two products have grown rapidly, and growth in NEV exports has outpaced that in exports of conventional vehicles.

Chinese automobile exports, especially exports of NEVs and related products such as batteries, are poised to play a pivotal role in driving the country’s export growth. China’s NEV industry has a lot of potential considering its technology is only slightly behind competitors in developed economies — and it is even ahead in some areas. Moreover, the vast domestic demand for NEVs allows China to achieve significant economies of scale, further enhancing the competitiveness of its exports.

In terms of other products, China’s exports of chemical and steel products have grown rapidly over the past couple of years, particularly to neighboring countries. China possesses certain advantages in exporting bulk commodities, such as its considerable amount of efficient new production capacity. However, China’s reserves of petroleum and iron ore are limited. If the country were to expand its chemical and steel exports, it would need to import petroleum and iron ore in large quantities. Therefore, in the long term, chemical and steel products are unlikely to become major drivers of China’s goods exports.

Read also the original story.

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: Kal’vān- stock.adobe.com