In Depth: Why China’s Project Whitelists Can’t Cure Real Estate Slump

By Wu Xiaomeng, Chen Bo, Zhu Liangtao and Qing Na

China’s cash-strapped property developers have been thrown a financial lifeline by the government through a new strategy — putting eligible housing projects on whitelists compiled by local authorities to help them get bank loans.

But the policy is creating tension between officials desperate to rescue their stagnant local property markets and financial institutions, who are under political pressure to hand out credit but are worried that lending to projects in a depressed market is high-risk and could saddle them with more nonperforming loans.

The pressure to disburse loans under the policy is significant for both the heads of local branches of national banks and the presidents of city commercial banks, several industry insiders told Caixin. Local governments have been convening meetings frequently with banks to report on the overall progress of loan disbursement and coordinate lending to projects listed in the whitelist mechanism.

“Bank presidents who perform poorly will be reprimanded and as for obtaining resources from local governments, they can forget about it,” one banking insider said.

The whitelist policy was jointly announced by the Ministry of Housing and Urban-Rural Development and the National Financial Regulatory Administration in January as part of a broader financing coordination mechanism for the property sector that aims to ensure viable projects with sufficient collateral can obtain the financing they need to complete construction and deliver new homes to their owners.

As of the end of March, all 31 provincial-level governments on the Chinese mainland had established such coordination mechanisms, updates from the housing ministry show. Under the mechanisms, nearly 2,000 projects had obtained lines of credit from banks amounting to about 470 billion yuan ($64.9 billion). Among them, 1,247 had secured loans totaling 155.4 billion yuan.

Insufficient quality

An official working in the credit department of a major state-owned bank told Caixin that although local counterparts of the housing ministry have forwarded a significant number of whitelisted projects to the bank’s branches nationwide, only a small fraction are of high quality and meet the bank’s lending criteria. “Some projects that clearly do not meet our loan requirements appear on the list,” the official said.

From the bank’s perspective, adding a project to the whitelist does not mean it’s risk-free, it merely serves as a bonus point, the person said. “For projects recommended by local housing departments, we carry out the necessary investigations and reviews as usual,” he said. “The fundamental requirements for loan approval and disbursement remain unchanged, but the process has become more efficient.”

Under the mechanism, local governments and financial institutions assess individual property projects rather than the developers backing them. Previously, many banks had adopted a stringent policy on lending, failing to distinguish between projects and developers in terms of risk assessment, industry insiders told Caixin. The change means the completion of some viable developments won’t be jeopardized even though developers themselves may be grappling with liquidity issues, they said.

A source working for a state-owned major bank told Caixin that separating the risks of a specific project from those of the developer makes it easier for banks to manage their risk exposure. They maintain strict control over the pace of fund disbursement and monitor the flow of the funds to ensure they are used for their intended purpose, he said.

Banking industry insiders told Caixin that lending to whitelisted projects is not a bonus point in the overall performance assessment of local branches, and that they will be held accountable if the loans turn sour.

Whitelist white knight

The whitelists cover two categories of projects: those that are operating smoothly and where additional financing will accelerate completion, and those that are temporarily struggling to progress and where funding support is provided to secure timely delivery of finished homes. Since the introduction of the mechanism, major domestic banks have been reviewing projects selected by local authorities and handing out loans based on the progress of individual projects.

Housing developments falling under the second category have been the main beneficiaries of the whitelists. A source working in the headquarters of a national joint-stock bank told Caixin that several projects had been on hold for some time as they were previously deemed ineligible for loans. But now they can be viewed as qualified for financing after being put on the whitelists, the source said.

Small and midsize private developers are also benefiting. Unlike their large or state-backed counterparts who normally receive preferential treatment from lenders, these private builders have faced discrimination in accessing financing. As the whitelist policy has been rolled out, many are now able to obtain funds from local banks, the official in a bank credit department told Caixin. “Although they are not getting huge sums of money, it’s still helping to relieve pressure on their finances,” he said.

Without the new mechanism, banks across the board may have scaled back lending for real estate-related projects, banking sources told Caixin. Even so, they cautioned against being too optimistic about its impact at this stage.

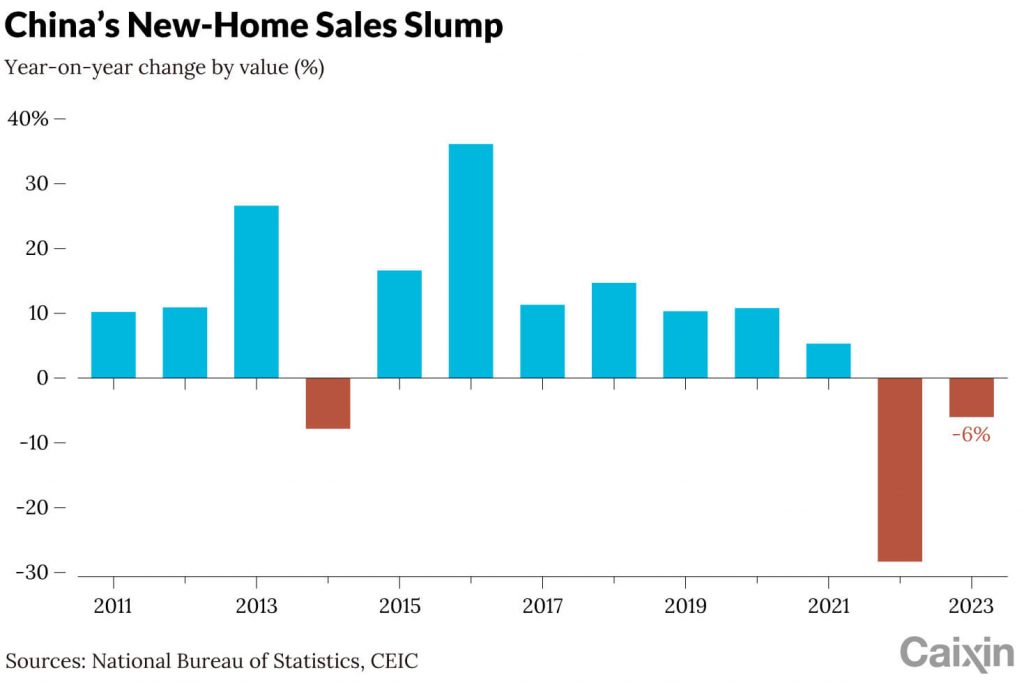

Sales of new homes have shown few signs of recovery, suggesting the downturn in the property market has not yet bottomed out. Last year, sales measured by value fell 6% nationwide following a 28.3% plunge in 2022, data from the National Bureau of Statistics show. The decline continued into the new year — the pace of the drop accelerated to 30.7% in the first quarter.

China Vanke Co. Ltd., one of the country’s largest listed developers, reported a 43% year-on-year drop in sales by value in March after a 53% slump in February. Country Garden Holdings Co. Ltd. reported an 83% collapse in sales last month compared with the same period in 2023 after an 85% crash in February.

Many developers who are operating normally are cautious about joining the whitelists. An executive with one of China’s leading developers told Caixin that the industry generally views developers whose projects have been included as struggling with financing.

“We have no problem applying for loans now, but if we start requesting that a large number of our projects be whitelisted, it could raise suspicions about our liquidity,” he said.

Projects that make it onto the whitelists also face being seen as risky, as not all are deemed to meet lenders’ funding benchmarks, banking sources told Caixin.

Supply vs. demand

The biggest concern among lenders, however, lies in the market’s capacity to absorb completed homes. “At the moment, who can guarantee all newly built homes can be sold?” one bank insider said. “Providing funding to ensure the timely delivery of completed homes or to whitelisted projects only addresses supply-side problems. If demand fails to keep up, banks will see their money going down the drain.”

The whitelists can only partially alleviate financing constraints, but they cannot fundamentally turn the property slump around, a vice president of a provincial branch of a major bank told Caixin. The biggest problem facing the housing market is sluggish demand — be it from first-home buyers or those wanting to upgrade, he said, noting that optimism about the outlook has evaporated.

Multiple sources familiar with property sales told Caixin that due to the continued weakness in the market, many developers will need to rely on price cuts to drive sales in the coming months.

Discounting could potentially transmit the property sector’s risks to banks, the official in a bank credit department warned. “If the downward trend of home sales continues, dragging on home prices, the value of banks’ collateral will also fall,” he said.

Read also the original story.

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: Govan – stock.adobe.com