Cover Story: How a China-Built Railway Is Connecting Ethiopia to the World

By Sun Liangzi from Ethiopia and Han Wei in Beijing

In the pre-dawn glow at the Akaki station just outside Addis Ababa, Ethiopia’s capital, people wait to board a train that quite literally connects Africa’s second most populous country to the world.

Utilizing the train has become a daily ritual for passengers – and more importantly for freight handlers – since 2018, when the Chinese-built Addis Ababa–Djibouti Railway, the first electrified cross-border rail line in Africa, was launched, linking the land-locked Ethiopia with the Port of Doraleh in neighboring Djibouti and the Red Sea.

That port handles more than 90% of Ethiopia’s international trade, underscoring the significance of the new railway, that also links industrial parks and dry ports, according to the G20-backed Global Infrastructure Hub (GI Hub). The railway is expected to bring considerable advantages for long-haul transport of freight, including massively reduced travel times, from up to 50 hours down to 10 hours, according to the GI Hub.

The same journey used to take seven days via roads and a 19th-century narrow gauge railway.

The project involved total investment by China of nearly $4 billion, including $2.9 billion yuan funded by loans from the policy lender the Export–Import Bank of China. It now serves as the backbone of the new Ethiopian National Railway Network and is also the first overseas railway project to fully adopt Chinese technologies from design to construction.

This year marks a milestone for the railway, which has been held up as an exemplar of Beijing’s Belt and Road Initiative (BRI), as China fully hands over the daily operation of the service. For the past six years the 752-kilometer railway has been overseen by Chinese engineers and managers, but during that time they have transferred crucial knowledge and skills in operation, maintenance, and management to their local partners.

Since its launch, the Addis–Djibouti Railway has transported over 677,000 passengers and nearly 9.47 million tons of freight, generating about $502 million in transport revenue, according to Ethiopian government data.

By the end of 2023, the Addis-Djibouti Railway had assembled a team of over 3,000 local professionals. Over the next two years, the Chinese involvement will shift towards providing merely technical support.

Hailed by local officials as “a road to prosperity,” the Addis-Djibouti Railway is anticipated to forge a conduit for driving economic growth and industrial development in both Ethiopia and Djibouti.

For China, the project marks a breakthrough in exporting its homegrown railway technology. It has also become a gateway for many Chinese businesses to enter the massive African market.

Between January and November 2023, bilateral trade between China and Ethiopia soared to $2.76 billion, a 15.5% increase from the previous year, according to data from China’s Ministry of Foreign Affairs.

Chinese exports accounted to the vast bulk at approximately $2.36 billion including light industrial and high-tech products, machinery, textiles, and pharmaceuticals. Ethiopia meanwhile is China’s leading source of sesame, according to the data.

Overall, China-Africa trade volume reached a historical peak of $282.1 billion in 2023, maintaining a growth of 1.5% compared to the previous year. China has remained Africa’s largest trading partner for 15 consecutive years, according to the data.

It has been part of a trend with the BRI, with investment in countries involved in the scheme rising last year to the highest since 2018, according to a new joint report from Griffith University in Australia and Fudan University in Shanghai, with companies putting almost $50 billion into overseas projects.

Total investment was almost 80% higher than in 2022 and helped take total engagement with the 150 countries that have signed up to the infrastructure initiative to more than $1 trillion since 2013, according to the report.

Chinese expertise

Construction of the Addis–Djibouti Railway was started in 2012 by China Civil Engineering Construction Co. Ltd. (CCECC), a unit of state-owned China Railway Construction Co. Ltd., and China Railway No.2 Engineering Group Co. Ltd., a subsidiary of China Railway Group Ltd.

Planning started back in 2010, when Ethiopia proposed an ambitious plan to build an extensive electrified railway network of over 5,000 kilometers lines and connecting neighboring Djibouti, Kenya, Sudan, and South Sudan. The Ethiopian government had sought financial support from countries including China, India, Turkey, and Brazil to proceed with the plan.

With a population of 120 million, Ethiopia is one of the continent’s fastest-growing economies. But the country has relied on the tiny coastal nation of Djibouti to handle virtually all of its imports and exports.

In early 2011, the Ethiopian government invited CCECC to bid for the railway project. In January 2012, a consortium formed by CCECC and China Railway signed a contract for the Addis-Djibouti Railway, according to a journal backed by China’s State-owned Assets Supervision and Administration Commission.

It was a period when China’s domestic railway was undergoing a major upgrade, with the government beginning to seek opportunities abroad, according to Long Zongming, chief engineer of China Railway Eryuan Engineering Group Co. Ltd. who led the design of the Addis-Djibouti Railway.

Between April 1997 and April 2007, China’s railways underwent six significant speed enhancements, elevating average speeds from 48.1 kilometer per hour (km/h) to peaks of 250 km/h.

In August 2008, the Beijing — Tianjin Intercity High-Speed Railway was launched, boasting top speeds of 350 km/h and propelling China to the lead in global high-speed rail velocities. By the end of 2009, with 2,319 km of high-speed railways in operation, China claimed the title for the world’s most extensive high-speed rail network.

Despite these achievements, China’s railway technology had not convinced potential foreign customers, including the Ethiopian government.

“We invited officials of the Ethiopian railway system to China, enabling them to personally experience the Beijing-Tianjin Intercity Railway,” said Long.

The contract was eventually finalized for the Addis-Djibouti Railway, aiming to build an electrified railway line following Chinese standards with a design maximum speed of 120 kilometers per hour for passenger trains and 80 kilometers per hour for freight trains.

After four years of construction, the Addis-Djibouti Railway officially opened in October 2016. During its construction phase, about 27,000 Ethiopian and 5,000 Djiboutian workers were employed.

Local knowledge

Before the railway’s completion, a tender for its operation and management rights was held in August 2015. A consortium of CCECC and China Railway beat out rivals from Turkey, France, Germany, among others.

According to Yuan Li, then chairman of CCECC, the Chinese companies committed to training Ethiopian workers on how to operate and manage the railway over a six-year operation period, ultimately enabling Ethiopia to take full control this year.

In July 2016, the Chinese consortium signed a six-year railway operation and management service contract with the Ethio-Djibouti Standard Gauge Railway Share Company (EDR), a joint venture established by Ethiopian and Djiboutian authorities. This contract became effective on January 1, 2018, when the line started commercial services.

CCECC once disclosed that the value of a six-year commercial operation contract was about $400 million, marginally exceeding the labor costs with limited room for profit.

Since August 2023, the Chinese operator has relinquished most management tasks to EDR, in preparation for the final handover of operations. By the end of the year, the size of the Chinese operations team had been drawn down from more than 700 individuals to just over 90.

“This railway belongs to Ethiopia and Djibouti, and ultimately it should be operated by them,” said a Chinese manager.

Beyond ensuring safety and developing local talent, the Chinese operator faced a vital task: “To ensure the railway’s long-term viability, it must be profitable,” said Wang Xinjun, a senior manager overseeing the railway’s transport and passenger services.

Since commencing commercial operations in 2018, the Addis-Djibouti Railway has seen annual revenue growth of over 35%, with its income rising from 700 million Ethiopian Birr ($12 million) in 2018 to more than 3.64 billion Birr in 2023. Freight accounts for approximately 95% of this revenue, all going to the EDR, Wang said.

“Based on annual revenue and expenses, the Addis-Djibouti Railway reached the break-even point in 2022,” he said.

Freight rates on the railway average $0.05 per ton-kilometer, only 60% of road haulage costs, according to Ding Rui, a Chinese businessman who runs logistics company AfriTrans in Ethiopia.

Over the years, the range of goods transported by the rail line has broadened to include grain, fertilizer, steel, cement, cold chain logistics, and specialized car transport trains.

In 2020, the Addis–Djibouti Railway introduced a special petroleum line along its eastern route, linking to National Oil Ethiopia’s unloading facilities.

Should the petroleum branch manage two pairs of freight trains daily, it has the potential to double the railway’s revenue, said Feng Chao, a marketing manager of the railway.

Business corridor

Ethiopia is predominantly an agricultural nation. In the 2020/2021 fiscal year, goods exports totaled around $3.6 billion, with 80% being agricultural products like coffee, flowers, oilseeds, and legumes, according to the National Bank of Ethiopia.

But, mirroring the early years of China’s reform and opening-up, which started in the late 1970s, Ethiopia is now committed to developing the industrial sector to drive economic growth.

China’s infrastructure investments have been pivotal in unleashing Ethiopia’s production capabilities, transforming it into a manufacturing hub in East Africa, said Arkebe Oqubay, Special Adviser to the Prime Minister of Ethiopia.

An official from the Ethiopian Investment Commission told Caixin that investment inflow from China has become a “pillar of Ethiopia’s economic growth,” boosting employment and technology transfers. With its competitive labor market, Ethiopia stands out in Africa for valuing foreign investment, offering mutual advantages to Chinese investors, said the official.

As of the end of 2022, Chinese enterprises’ direct investment stock in Ethiopia amounted to $2.62 billion, according to China’s Ministry of Commerce.

One area that has attracted investment dollars is industrial parks. Constructed by Chinese businessman Lu Qiyuan, the Eastern Industrial Zone is Ethiopia’s first operational industrial park. Situated 35 kilometers from the capital in Dukem city, Oromia region, it resembles southern China’s manufacturing hub Guangdong during the labor migration wave of the 1990s.

About 20,000 young Ethiopians have been hired by over a hundred enterprises in the park, spanning industries like building materials, footwear, textiles, clothing, and food.

Guangdong-based shoemaker Huajian Group was among the earliest Chinese companies to set up in the Eastern Industrial Zone in 2011. In March 2012, Huajian commenced the export of shoes produced in Ethiopia, and by May of the same year, it had become the nation’s largest exporting enterprise.

By the end of 2023, Huajian has generated a total of $183 million in export revenue for Ethiopia, said the company.

“Labor-intensive industries like shoemaking are similar to migratory birds, moving to wherever labor advantages exist,” said Zhang Yuqi, vice president of Huajian.

According to Zhang, an abundant supply of leather, and cheap labor and energy costs have all benefited Huajian’s business, and to boost efficiency, Huajian has brought its entire business chain to Ethiopia, said Zhang.

As urban development advances, Ethiopia’s demand for construction materials like cement and aluminum steel has been increasing, attracting Chinese entrepreneurs like Zhou Chunlong who operates an aluminum company in the Eastern Industrial Zone.

While profits for primary industrial products like aluminum and cement have fallen in China due to fierce competition, in Ethiopia it’s a seller’s market with demand outstripping supply, said Zhou.

Chinese tech majors like Huawei Technologies Co. Ltd. and smartphone maker Transsion Holdings are also expanding quickly in Ethiopia. According to Ye Liming, a public relations officer for Huawei Ethiopia, the company employs nearly 600 staff in the country, more than 80% of which are local hires.

From January to September 2023, around 140 new Chinese-funded enterprises were registered in Ethiopia, focusing on textiles, electronics, rubber and plastics, metal products, and furniture, according to China’s commerce ministry.

Li Lin, a Chinese coffee trader, began exporting Ethiopia’s coffee beans to China in 2016 and has gained a measure of fame in China’s specialty coffee circles. According to Li, the Chinese mainland now imports over 20,000 tons of coffee from Ethiopia, becoming the sixth-largest buyer in terms of annual export volume.

Since the Addis–Djibouti Railway became operational, freight costs have halved and transit times cut by two-thirds, Li said.

Read also the original story.

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

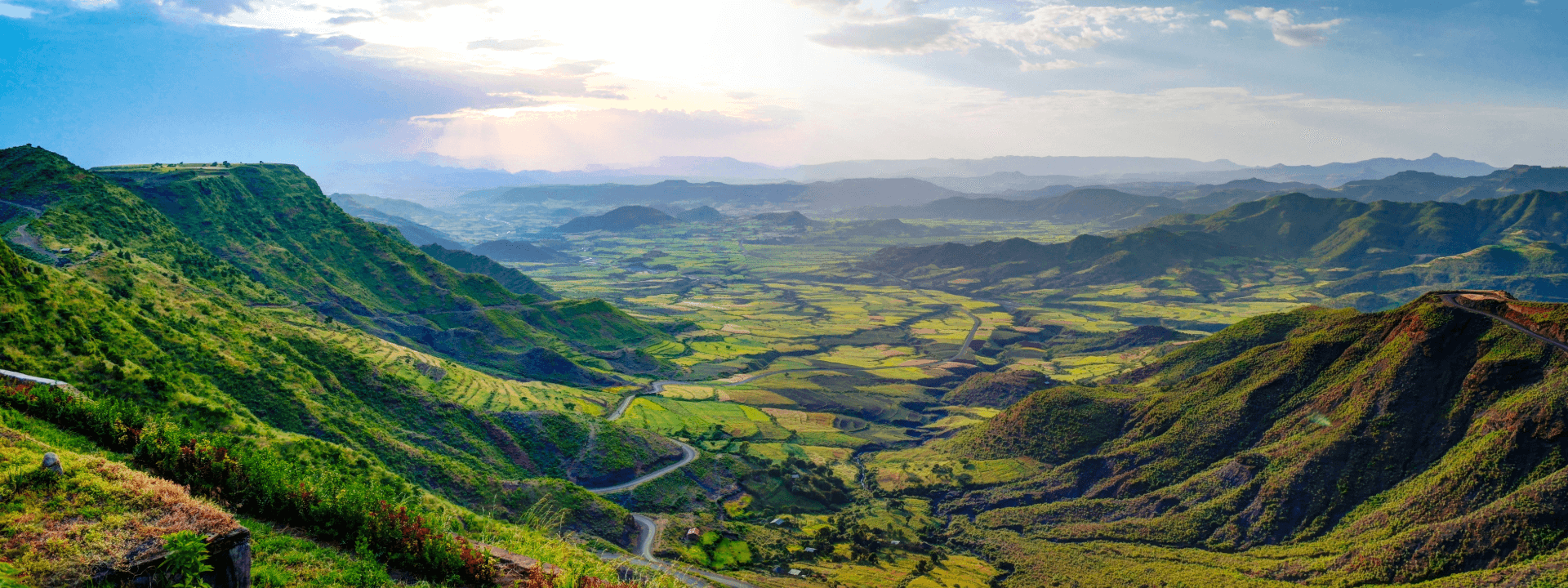

Image: homocosmicos – stock.adobe.com