China’s Factory Activity Expansion Loses Momentum, Caixin PMI Shows

By Zhang Ziyu

The recovery in China’s manufacturing sector lost a step in June, a Caixin-sponsored survey showed Monday, despite government efforts to prop up the economy.

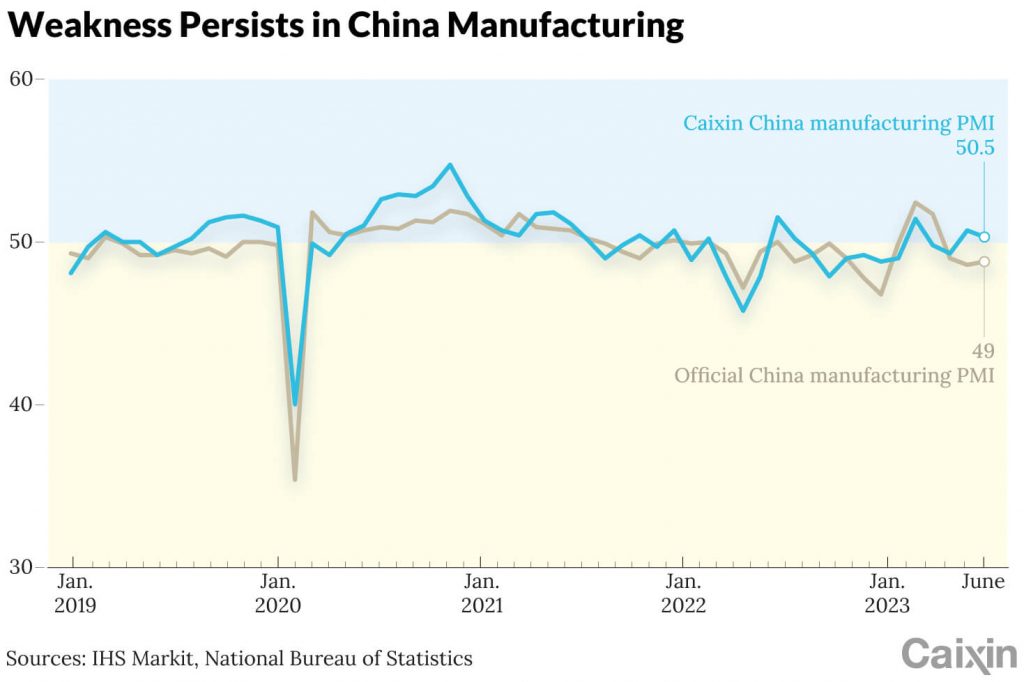

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the sector, slipped to 50.5 from 50.9 the previous month. A reading below 50 indicates a contraction in activity, while a number above that signals an expansion.

The PMI is one of the earliest available monthly indicators of business activity in the world’s second-largest economy. In the first quarter this year, manufacturing accounted for 28% of China’s GDP, according to government data.

“In a nutshell, manufacturing activity growth suffered a marginal slowdown,” said Wang Zhe, senior economist at Caixin Insight Group.

June’s PMI survey reflected issues ranging from “an increasingly dire job market to rising deflationary pressure and waning optimism,” he said, all of which point to the fact that China’s economic rebound has yet to find a stable footing.

The Caixin PMI release came after multiple official economic data for May undershot expectations and prompted several major financial institutions to downgrade their China growth projections.

In May, youth unemployment hit a new record high, private sector investment shrank, and property development investment continued to slump. This has led China’s State Council to reiterate a vow to beef up support for investment by private businesses, which typically absorb a large portion of the youth workforce.

China stepped up its monetary easing last month by cutting key policy rates including the one-year medium-term lending facility rate, which led to declines in two lending benchmarks, namely the one-year and five-year-plus loan prime rates. However, some economists doubt the effect of such measures given the real economy’s current low sensitivity to rate cuts.

The dip in June’s Caixin PMI was partly due to slowing growth in market supply and demand, with the subindexes for both manufacturing output and total new orders falling within expansionary territory. New export orders also saw a marginal slowdown in expansion amid a sluggish global economy.

Meanwhile, employment in the sector deteriorated last month. Manufacturers’ optimism also waned on concerns about a weaker-than-expected economic recovery, Wang said, with the reading for future output expectations sinking to a low not seen since October.

Adding to that was mounting deflationary pressure, which led prices to plunge further. Businesses’ input costs dropped at the fastest pace since January 2016, weighed down by falling prices of bulk commodities, while their fees charged to customers also declined amid weak demand, Wang said.

In contrast, suppliers’ shorter delivery times and manufacturers’ increased stocks of raw materials helped make up for the loss in the index.

“A slew of recent economic data suggests that China’s recovery has yet to find a stable footing, as prominent issues including a lack of internal growth drivers, weak demand and dimming prospects remain,” Wang said. “In the future, stronger policy support is needed on the macro level, along with higher implementation efficiency from a micro perspective, to ensure that policies benefit market players directly and therefore bolster employment and market expectations.”

While June’s Caixin PMI pointed to a slower expansion, the official manufacturing PMI, released by the National Bureau of Statistics on Friday, painted a grimmer picture. The official indicator, which surveys a larger share of big companies and state-owned enterprises than the Caixin PMI, remained in contractionary territory in June, despite inching up to 49 from 48.8 the previous month.

“Looking forward, policy support will be key to preventing a further deceleration in growth,” economists with Capital Economics Ltd. wrote in a Friday note on the official figure. “Aside from some token rate cuts, officials have so far been slow to announce meaningful stimulus.”

“Unless concrete support is rolled out soon, the recent downturn in demand risks becoming self-reinforcing,” they said.

Read also the original story.

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: TTstudio– stock.adobe.com