In Depth: China’s E-Commerce Giants Launch Multibillion-Dollar Blitz to Deliver the Future

By Bao Yunhong and Han Wei

For years, China’s massive e-commerce industry was a battlefield of entrenched rivals, each defending their turf in a relatively stable and predictable manner. That era is over.

In 2025, the sector erupted into a full-scale blitz, as companies abandoned their traditional silos and began encroaching on each other’s territory in a fierce bid for dominance.

The clear boundaries that once separated online shopping, food delivery and travel booking have all but vanished. Industry titans are now clashing across multiple fronts, backed by tens of billions of yuan in subsidies, in what has become an increasingly costly race to define the future of digital commerce.

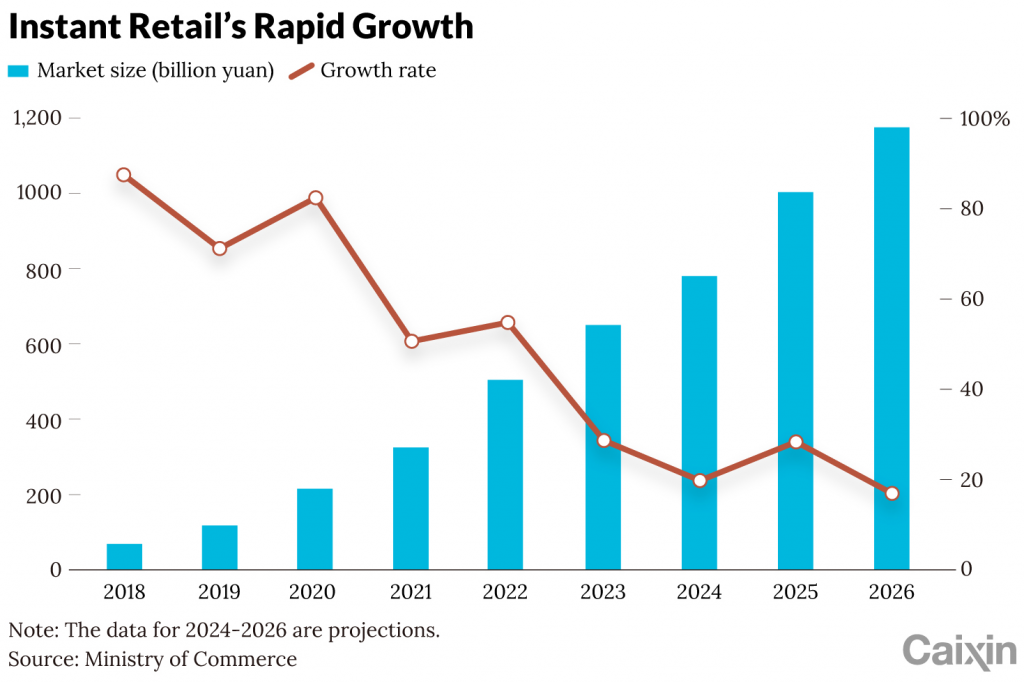

At the center of the upheaval is the explosive growth of “instant retail,” offering everything from takeout and fresh produce to smartphones and vacation packages — all delivered in less time than it takes to watch a movie. The shift from next-day to next-hour delivery has triggered a costly scramble for market share.

For companies such as Alibaba Group Holding Ltd., JD.com Inc. and Meituan, the stakes couldn’t be higher. With traditional e-commerce growth slowing, these firms are placing bold bets — not just to capture a share of the estimated 1.5 trillion yuan ($209 billion) instant retail market, but also to use high-frequency services like food delivery to cross-sell more profitable, lower-frequency offerings, according to a recent Goldman Sachs report.

China’s Ministry of Commerce predicts the instant retail market will exceed 2 trillion yuan by 2030.

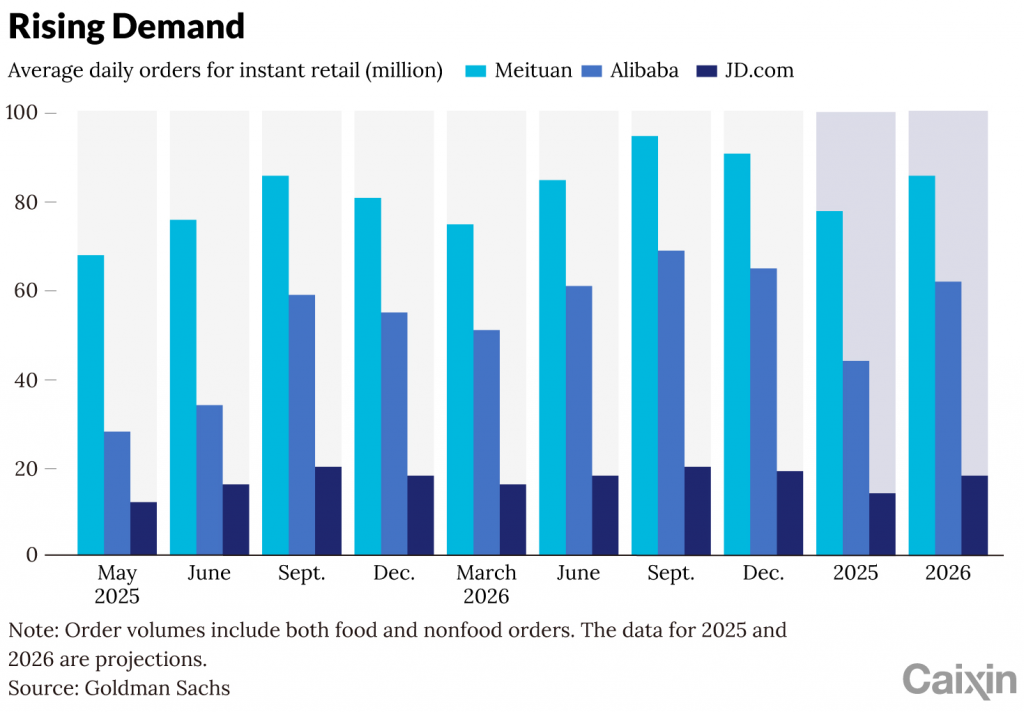

The current phase of the turf war began in earnest when JD.com charged into food delivery, luring consumers with generous subsidies. By June, the company said it had surpassed 25 million daily delivery orders — a direct challenge to Meituan’s dominance. The move sparked swift retaliation. Meituan and Alibaba scaled up their instant retail efforts, turning a once-niche segment into the hottest battleground in Chinese tech.

Meituan hit back by targeting JD’s stronghold: big-ticket electronics. During this year’s “618” midyear shopping festival — a weeks-long sales event launched by JD.com — Meituan slashed prices on iPhones, tablets and home appliances. On May 26, the festival’s opening day, Meituan’s instant retail arm, Shangou, reported a twofold increase in total sales from a year earlier, with digital product sales surging nearly sixfold.

In July, Alibaba entered the fray with a 50-billion-yuan subsidy blitz to supercharge its own instant retail business. Combined, the daily peak order volume across JD.com, Meituan and Alibaba has now surpassed 220 million, double the figure at the start of the year.

These subsidies have fueled a user boom. JD’s monthly active user base grew 14.08% to 637 million by June. Meituan saw a 9.85% increase, reaching 511 million. Alibaba’s Taobao and its food delivery arm Ele.me gained 4.77% and 8.87%, respectively.

But these gains come at steep cost. Goldman Sachs estimates the three firms burned through a combined 25 billion yuan in the second quarter alone. Between July 2025 and June 2026, JD.com and Alibaba are projected to lose 26 billion yuan and 41 billion yuan, respectively, on food delivery. Meituan could see pretax profit shrink by 25 billion yuan.

Still, the fight is broadening. In June, JD.com entered online travel — a market long dominated by Trip.com Group Ltd. — by offering three years of zero commission. The move threatens to shake up a sector that hasn’t seen a serious price war in over a decade.

“The market needs challengers,” said Zhou Mingqi of Jingjian Think Tank. “But JD.com faces tough odds.”

Expanding the turf war

Tensions between tech giants had been simmering since February 2025, when JD.com intensified its foray into food delivery, directly challenging sector leaders Meituan and Ele.me.

The food delivery market had remained relatively stable since its last shake-up between 2014 and 2016. By 2024, Goldman Sachs data showed Meituan controlling 71% of the food delivery segment, with Ele.me at 28%. In non-food instant retail, Meituan led with a 50% market share, followed by Taobao and Ele.me with a combined 26%, while JD.com trailed with 13%.

In May, Alibaba responded by launching “Taobao Flash Sale,” which integrated Ele.me’s delivery network with Taobao’s user base and physical store partnerships for 30-minute fulfillment. On June 23, Alibaba merged Ele.me and its travel platform Fliggy into its core domestic e-commerce business.

“The goal is to attract new users and boost engagement,” said Jiang Fan, CEO of Alibaba’s e-commerce business group. During the 618 shopping event, Alibaba reported double-digit user growth and a 10% increase in year-on-year gross merchandise value (GMV), driven by this new feature.

JD, for its part, increased subsidies to channel food delivery traffic back into its core platform. From May 13 to June 18, the company said daily active users hit a record high and the number of ordering users more than doubled.

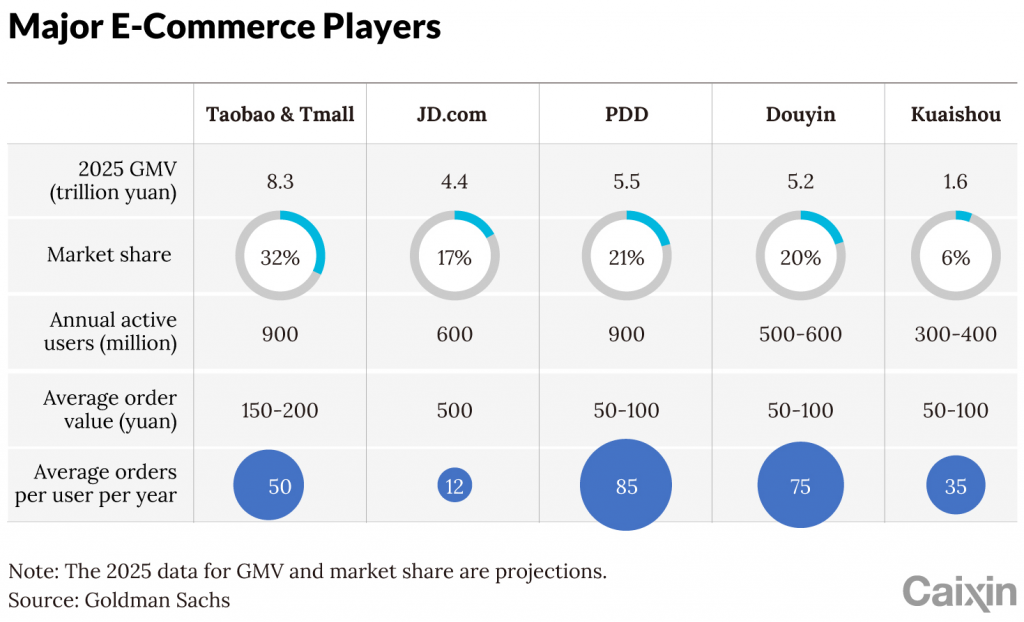

China’s e-commerce sector is approaching saturation. March 2024 data from QuestMobile showed Taobao, Pinduoduo and JD.com had 928 million, 677 million and 507 million monthly active users, respectively. With few new users left, firms are fighting for each other’s customers.

JD.com has long trailed in user engagement. Before entering food delivery, its daily active user numbers were just a third of Taobao and Pinduoduo. But the pivot appears to be paying off. In May, JD’s instant retail user base reached 165 million, accounting for 26.6% of app traffic, with usage frequency up 51.1% to nearly 48 visits per user per month, according to data from QuestMobile.

Taobao also saw gains. On June 18, daily active users reached 457 million — a 5.1% increase from a year earlier, according to QuestMobile.

Speed matters

Growth in China’s traditional online retail sales has slowed to a crawl, dropping to 6.5% in 2024 after years of explosive expansion. This slowdown has hit incumbents hard: JD’s core retail growth dropped to 1.66% in 2023, and Alibaba’s Taotian Group has seen flat or negative growth for three straight years.

In contrast, instant retail is projected to expand 29% in 2025, according to the Ministry of Commerce.

Meituan made an early move with Meituan Shangou, whose rapid rise directly challenged JD’s signature next-day delivery model. By using partnerships and franchised warehouses, Meituan has built an asset-light delivery network that it plans to expand from 30,000 to 100,000 warehouses by 2027.

JD.com and Alibaba are racing to catch up. JD’s logistics arm has launched its own warehousing service for instant delivery, while Alibaba’s 50-billion-yuan subsidy pledge aims to bolster its delivery capabilities, though it remains unclear whether the funds are earmarked for infrastructure or marketing.

The outcome of this high-stakes contest remains uncertain, with a recent Goldman Sachs report outlining several possible scenarios: Meituan could maintain its dominance, securing a 59% share of the non-food instant retail market; a powerful synergy between Alibaba’s Ele.me and Taobao Flash Sale could create a duopoly, splitting the market nearly evenly; or JD’s aggressive investment could pay off, pushing it past the 20% mark and reshaping the landscape once again.

JD.com’s travel gamble

While the race in instant retail heats up, JD.com is reviving a campaign in one of China’s most entrenched digital markets: online travel. The company is betting on its supply chain strengths — but it’s a risky gambit in a sector with high barriers to entry, where JD.com itself has stumbled before.

For more than a decade, China’s online travel market has been an oligopoly. Trip.com, along with its wholly owned subsidiary Qunar and affiliate Tongcheng Travel, controls over 60% of the market. Meituan’s travel arm and Alibaba’s Fliggy together account for under 30%, leaving little room for new entrants.

In 2015, JD.com invested $500 million in travel agency Tuniu becoming its largest shareholder — but sold its entire stake five years later at a loss of nearly 80%.

The travel market’s appeal is its rich profits, a stark contrast to the cutthroat margins of e-commerce and food delivery. In the first quarter of 2025, Trip.com reported a gross margin of over 80% and a net profit margin of 31%. JD’s ambitions extend beyond trip bookings to the lucrative hotel supply chain, including everything from linen and cleaning services to furniture and smart home systems.

Insiders note that JD’s reach may be limited to small hotels, as large chains typically have in-house procurement.

”JD’s zero-commission offer might appeal to smaller players,” said Zhou of Jingjian Think Tank, “but breaking into the entrenched ecosystem will be tough.”

Meanwhile, JD’s rivals are not standing still. Alibaba has folded its Fliggy travel unit into its main e-commerce group to foster greater synergy while Meituan, which competes with Trip.com by focusing on smaller cities, is monitoring the space closely.

“In the short term, a price war in the travel industry is inevitable,” said Jiang Yunying, a partner at Roland Berger. “But in the long run, ecosystem synergy will be the deciding factor.”

Feng Yiming, Qu Yunxu and Ji Ran contributed to this story.

Contact reporter Han Wei (weihan@caixin.com)

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: Nisit – stock.adobe.com