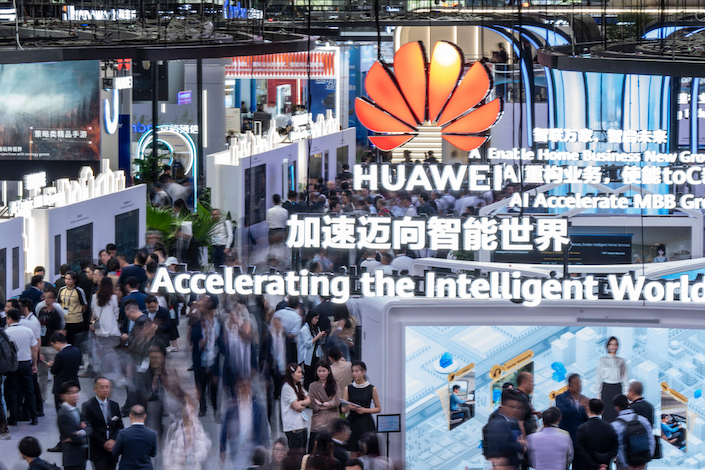

Huawei Unveils Three-Year AI Chip Roadmap as Nvidia Faces Setbacks in China

By Zhang Erchi and Denise Jia

Huawei Technologies Co. Ltd. on Thursday unveiled an ambitious roadmap for new artificial intelligence hardware, challenging Nvidia Corp.’s dominance with a plan to launch four advanced chips by 2028 as the U.S. firm faces mounting pressure in China.

At its annual All-Connect Conference, rotating chairman Xu Zhijun announced that Huawei will release the Ascend 950 PR chip in the first quarter of 2026, followed by the 950 DT in late 2026, the 960 in late 2027, and the 970 in late 2028.

“Compute power has been, and will remain, the core of AI — and for China, it is the most critical element,” Xu said. He vowed Huawei would double performance nearly every year to ensure domestic supply keeps pace with surging demand.

The roadmap signals progress in overcoming bottlenecks in local production capacity, which have constrained Chinese chipmakers since U.S. sanctions cut Huawei off from Taiwan Semiconductor Manufacturing Co. Ltd. in 2020. Huawei recently drew attention by equipping its foldable Mate XTs smartphone with a Kirin 9020 processor, the first high-end Kirin chip unveiled in four years.

Huawei first launched its Ascend series in 2018, when the Ascend 910 outperformed then-mainstream Nvidia chips. Plans to scale up collapsed after sanctions, forcing production back to the Chinese mainland and resulting in updated 910B and 910C models.

The upcoming Ascend 950 line will target specialized workloads: the 950 PR for inference and recommendation tasks with 128GB of memory and 1.6 TB/s bandwidth, and the 950 DT for decoding and training, offering 144GB of memory and 4 TB/s of bandwidth. The 960 is designed to double memory, bandwidth and compute over the 950 DT, while the 970 aims to double performance again.

Huawei also mapped out new versions of its Kunpeng server processors, introducing the 950 in early 2026 with 96- and 192-core variants, and the 960 in 2028 with up to 256 cores. Xu said the goal is to replace mainframes and Oracle Exadata servers in China’s finance and telecom industries.

Globally, Nvidia remains Huawei’s main competitor, but its grip on China is weakening. In July, Chinese regulators summoned Nvidia over security concerns tied to its H20 chip. Days later, China’s antitrust regulator opened an investigation into the company. Analysts said cloud providers like Tencent Holdings Ltd. have since cooled on the H20 and are exploring domestic alternatives.

Huawei faces stiff competition at home as well. Cambricon Technologies Corp. Ltd., Alibaba’s semiconductor unit T-Head and Baidu-backed Kunlun Tech Co. Ltd. have all introduced AI chips compatible with Nvidia’s CUDA software ecosystem, making them easier for developers to adopt. Huawei relies on its in-house CANN platform, which Xu admitted presents a steep learning curve.

“Software ecosystems are built by use,” Xu said, comparing it to consumer loyalty to Apple’s iOS. He argued that if Nvidia chips become unavailable, engineers will eventually switch. To accelerate adoption, Huawei pledged to fully open-source CANN and related tools by the end of 2025.

“If Chinese companies can pull together, software ecosystems won’t be a problem,” Xu said.

Still, Huawei’s chips lag Nvidia in terms of efficiency, since they cannot access the latest semiconductor manufacturing processes. Huawei’s solution is scale: building massive supercomputing clusters using thousands of Ascend cards connected via optical interconnects.

In March, Huawei launched its Atlas 900 cluster, linking 384 Ascend 910C chips for peak performance of 300 petaflops — at the time, the largest single AI cluster in the world.

By late 2026, Huawei plans to unveil the Atlas 950 supernode, supporting more than 8,000 Ascend 950 DT chips across 160 cabinets. Company figures suggest it will deliver 6.7 times the compute of Nvidia’s planned NVL144 cluster, with 15 times the memory and 62 times the interconnect bandwidth.

Huawei intends to go even bigger. In late 2027, it expects to release the Atlas 960, supporting more than 15,000 chips and occupying 2,200 square meters of floor space.

Contact reporter Denise Jia (huijuanjia@caixin.com)

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: AntonKhrupinArt – stock.adobe.com