Commentary: Semiconductors Deserve Long-Term Investment in Beijing’s Push for Self-Sufficiency

By Gu Wenjun

The value of the global semiconductor industry is projected to reach a record high of $1 trillion in 2026. At the same time, China’s chip industry will continue to thrive this year, with its value likely to grow at a rate of 20%. Despite these optimistic estimates, many venture capitalists in China are stepping back from semiconductors to invest more in technologies including nuclear fusion, commercial aerospace and robotics. That shift may prove wrong.

Foundation of cutting-edge technologies

The semiconductor industry has experienced decades of sustained expansion, with growth accelerating markedly over the past three years. From the growth logic and development trajectory of China’s semiconductor industry, its investment value remains undiminished.

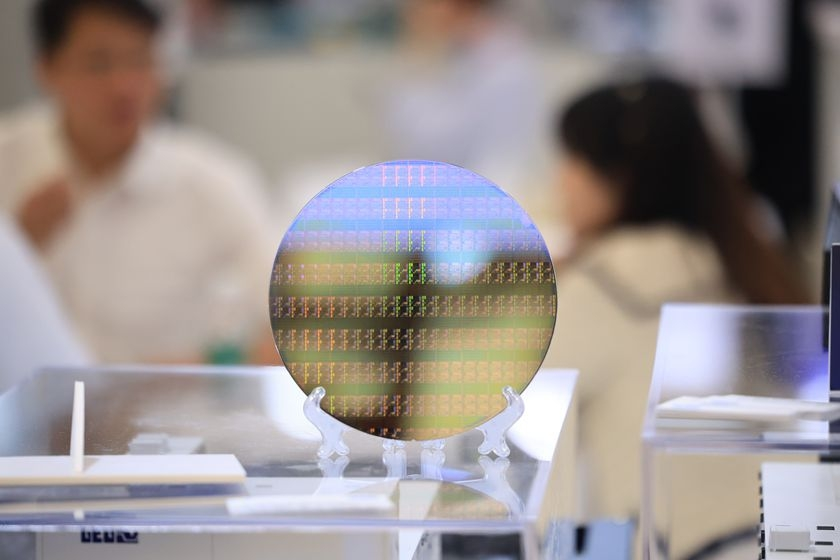

Semiconductors have long been a hot investment target in China, where the integrated circuit (IC) industry was defined as strategically important in 2006. Since then, the government has rolled out a series of favorable policies to support the development of the industry, including setting up the China Integrated Circuit Industry Investment Fund, also known as the “Big Fund.”

ICs are the foundation of nearly all high-tech industries as they are integral part of many cutting-edge technologies such as autonomous driving, robotics and industrial automation. For example, chips serve as the brain and communications hub of satellites, enabling them to operate reliably in environments marked by vacuum, microgravity and intense radiation.

Although China has made significant breakthroughs in chipmaking, it still lacks the ability to produce semiconductors that fully meet requirements for efficiency, stability and consistency. In light of it, sustained investments are needed for the country to achieve its goal of becoming self-sufficient in chip production.

An industry that promises stable returns

Compared with other emerging industries, the semiconductor industry offers a clearer path to profitability.

By contrast, the profit outlook for nuclear fusion, commercial aerospace and robotics remains highly uncertain, as all three are still far from large-scale commercialization. The feasibility of nuclear fusion has just been demonstrated in laboratory settings; commercial aerospace involves sensitive regulatory and security issues, with limited private capital participation; and the widespread application of robots remains in an exploratory stage. So, investing in these fields are just suitable for a small number of investors with strong foresight and the ability to bear substantial risks.

Investor enthusiasm for frontier technologies like nuclear fusion has been fueled by confidence gained from successful investments in electric vehicles (EVs) and semiconductors. That success, however, cannot guarantee similar returns from extremely innovative projects, particularly given many investors’ limited understanding of their underlying technologies. EVs and semiconductors have offered a clear path to industrialization and commercialization and have benefited from sustained support from the government and state-controlled investors.

The largest single financing in China’s commercial aerospace sector in 2025 was just 6.7 billion yuan ($961 million), while nuclear fusion is an extremely specialized field, in which only a handful of leading research institutions and centrally administrated state-owned nuclear power enterprises have the capacity to particulate.

Gu Wenjun is chief analyst at ICwise, a Shanghai-based semiconductor market research firm.

The views expressed in third-party articles are those of the authors and do not necessarily reflect the positions of Caixin.

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: Grafvision – stock.adobe.com