How Great Wall Motor Is Remaking Itself for Brazil

When Great Wall Motor Co. Ltd. set its sights on Brazil, the Chinese carmaker quickly learned that success would depend on more than exports. To better crack Latin America’s largest auto market, the company has had to rethink everything from engine technology to after-sales services — and even how Brazilians drive.

“Brazilians love to drive fast, and they prefer small cars,” Zhang Gengshen, president of Great Wall Motor’s Brazilian and Mexican operations, said in an interview with Caixin in early December. “The massive sugarcane industry has led to the wide use of biofuels in Brazil, where many cars run on ethanol. These usage habits are completely different from those in China.”

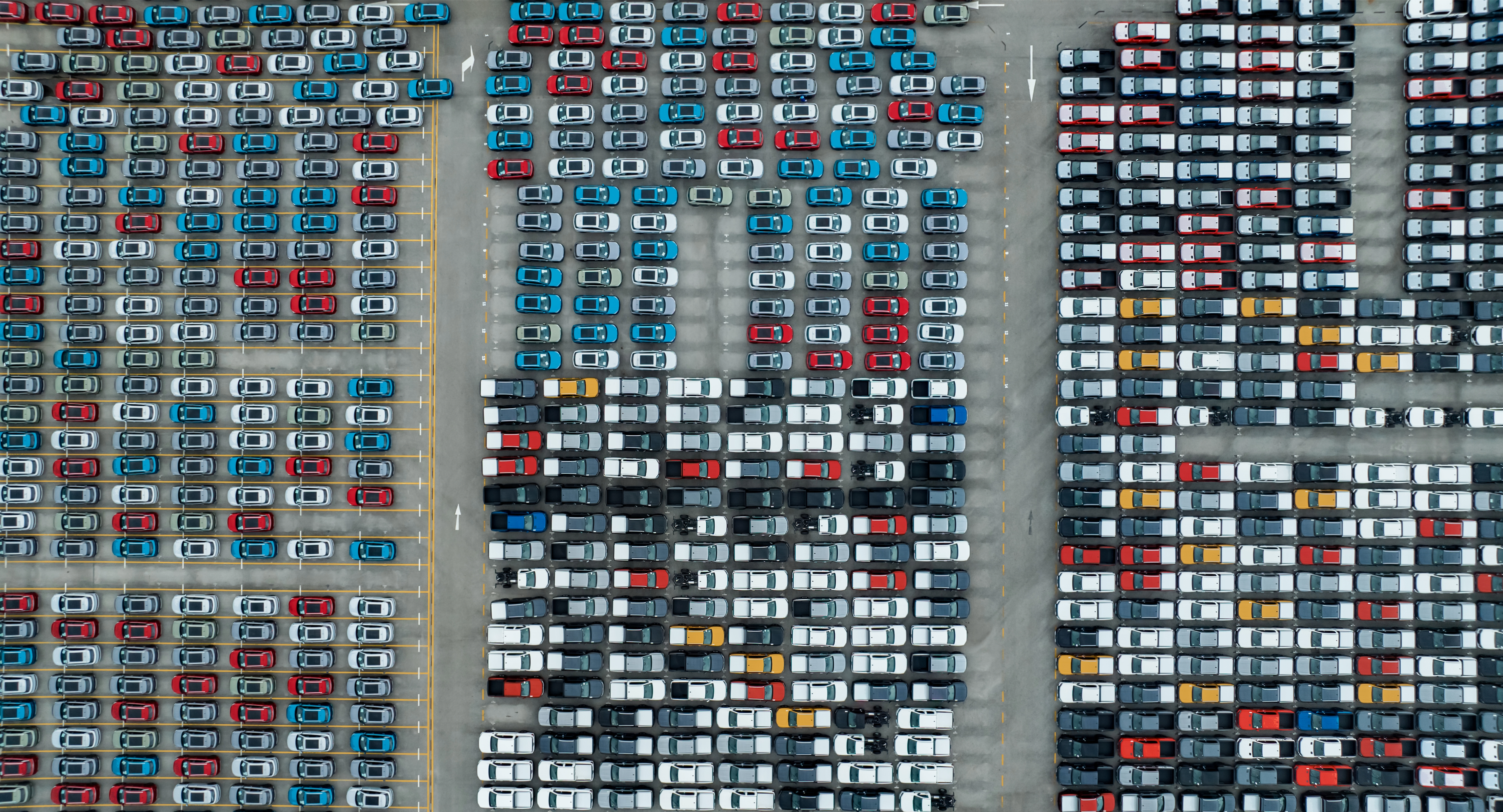

Zhang’s observations come at a pivotal moment for China’s auto industry. As trade tensions with the U.S. and Europe intensify, Chinese carmakers are pivoting aggressively to countries in the Global South. Brazil, the world’s sixth-largest auto market with annual new car sales of more than 2 million units, has become a primary battleground. According to the Brazilian Electric Vehicle Association, sales of light new-energy vehicles in the country grew 9.5% year-on-year in the first half of 2025 to 86,800 units, accounting for 8% of its total light car sales.

Chinese automakers already dominate this niche, holding a combined market share of more than 70%. In 2024, the three best-selling electric vehicles in Brazil were BYD Co. Ltd.’s Song, Great Wall Motor’s Haval H6 and BYD’s Dolphin Mini, according to data from Clean Technica. However, keeping that lead now requires deep localization as the Brazilian government raises import tariffs to push automakers to invest in local production.

Great Wall Motor formally started operations of its factory in Iracemápolis in August, marking the start of a new phase of competition with established Western brands. The facility, which was bought from Mercedes-Benz in 2021, has an initial annual capacity of 50,000 cars, which is expected to gradually rise to 100,000. The facility now makes the Haval H6, the Haval H9 and a hybrid, flex-fuel pickup called Poer, serving as a manufacturing hub to meet local demand and for export to other Latin American markets including Mexico, Argentina, Chile.

“We aim to sell 40,000 vehicles in Brazil this year, representing a year-on-year growth rate of around 40%,” Zhang said, adding that Great Wall Motor currently operates 120 stores across the country and plans to increase the figure to 130.

Meeting unique market demand

Brazil’s huge demand stems partly from infrastructural deficits. Brazil covers a land area of roughly 8.51 million square kilometers, yet public transportation remains severely underdeveloped. The country has only 37,000 kilometers of built railways, which are managed by four private companies, leaving intercity travel heavily dependent on automobiles.

“For Brazilians, cars are not only an extremely important tool for transportation, but also a major asset. This is very different from China.” Zhang said.

As the world’s largest sugarcane producer, Brazil churns out over 600 million tons of sugarcanes annually, making it the world’s second-largest maker of ethanol fuel. This abundance has shaped a unique market feature: the widespread use of gasoline blended with ethanol.

To accommodate this, cars sold in Brazil are typically equipped with engines capable for running on gasoline, ethanol or any mixture of the two. This required a technical pivot for Great Wall Motor, which has started manufacturing hybrid flex-fuel vehicles in Brazil. The company spent significant time conducting preliminary research to understand local road conditions and preference for small cars and flex-fuel technology before making its strategy or Brazil, according to Zhang.

Driving habits also dictated engineering adjustments. Brazilians tend to drive fast, increasing safety risks especially during the rainy season, when cars are more prone to skidding on wet roads. To address concerns about tail-flicking, side slips and rollovers, Great Wall Motor engineers adjusted tire grip and turning radius. They also joined drivers on long-distance durability tests to fine-tune vehicle performance based on driving habits and road conditions, according to Zhang

Residual value and after-sales services matter

Perhaps the most critical cultural nuance for Chinese automakers to master is the Brazilian view of a car as a core family asset that can be resold at a relatively high price. In 2024, approximately 15.78 million used cars were sold in Brazil, more than five times the number of new car sold.

That makes a car’s residual value a primary concern for drivers. Legacy automakers like Toyota Motor Corp. rely heavily on repeat customers who believe that their cars have a high residual value when resold or retired. A one-year-old Toyota in Brazil might retain about 89% of its original price. “Owners drive the car for two years and sell it without taking a major loss,” said Zhang.

This presents a significant challenge for many Chinese brands, which have long faced public skepticism over quality and durability. Many Brazilian consumers purchase cars with loans, and if a vehicle’s value depreciates faster than the loan is repaid, the financial impact can be severe, Zhang said.

To build trust and enhance user loyalty, Great Wall Motor has doubled down on after-sales services. The carmaker has established about 80 after-sales service stations across Brazil and a 20,000-square-meter warehouse near São Paulo to ensure parts availability. It has also established a training center in São Paulo to cultivate skilled maintenance technicians.

Zhang recalled a case in which a Brazilian customer got the windshield of his Tank 300 SUV repaired in a matter of days. “The owner was surprised when he got the car back, saying he had encountered the same problem with his Ford, which took more than two months to fix,” Zhang said.

Contact editor Ding Yi (yiding@caixin.com)

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: Artinun – stock.adobe.com